News from The Open University

On World Book Day find out how the OU’s Reading Schools Programme is helping more children to read for pleasure

Today is World Book Day and as children around the world excitedly mark the occasion by dressing up as their favourite literary character, or join in with special events at…

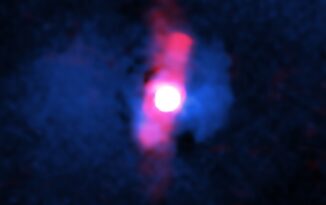

Students use NASA telescope to identify an underachieving black hole

An international team of students, including a PhD student from The Open University (OU) have revealed that a brilliant supermassive black hole is not living up to expectations in a…

500 ‘diagnostic’ assessments!? Time to reflect

Let me start with a story. Many years ago, I had a student who was struggling to get specialist support to meet his learning needs. He had dyslexia and was…

The latest Chocolate Scorecard highlights urgent need for industry change

The Open University (OU) is proud to be part of the 5th Edition of the Chocolate Scorecard that grades chocolate companies on their sustainability and ethics. The annual initiative is…

OU Alum Sir David Harrison, one of Universities UK’s 100 faces campaign

Sir David Harrison, MBA alumnus and Honorary Graduate of The Open University has been named…

Open University and BBC co-production nominated for a TV BAFTA award

The Open University/BBC award-winning documentary “Once Upon a Time in Northern Ireland” has been nominated…